Wealth is Not Income: The Post-Game Reality

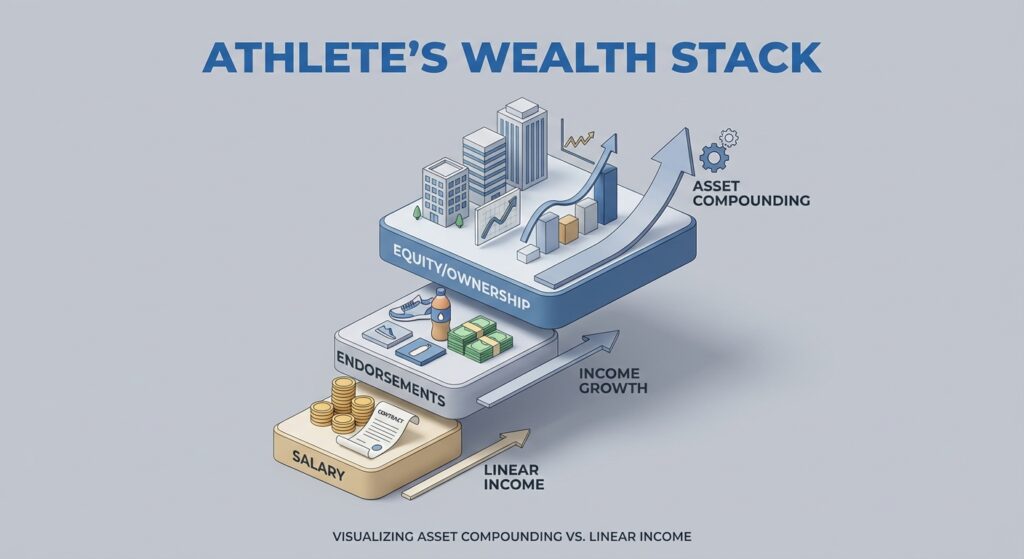

Most athletes go broke. It’s a statistic that refuses to die. They confuse a high salary with high net worth. But salary is linear. It requires you to show up. Wealth is different. Wealth compounds while you sleep.

The names on this list didn’t just save their game checks. They bought equity. They built brands. They understood that their time on the field was merely the seed capital for the real game: business. Playing sports is a job. Owning the team is an asset.

At the Institute Of Sports Sciences, ISST, we study these outliers not just to marvel at the zeros in their bank accounts, but to reverse-engineer their decision-making. How did a basketball player become a real estate mogul? How did a tennis player become a venture capitalist? It’s not magic. It’s specific, replicable business logic.

Before we dissect the retired legends, understand the broader context by reviewing our master guide: Richest Athletes in the World: The Billionaire Blueprint (2026). That is the macro view. This is the micro breakdown of the retired elite.

1. Michael Jordan: The Royalty King

Estimated Net Worth: $3.2 Billion+

Jordan is the standard. But not because he was the best scorer. Because he refused a flat fee. When Nike approached him in the 80s, the standard deal was cash upfront. Jordan, advised by his mother and agent David Falk, took a royalty. A percentage of every shoe sold.

This single decision created the greatest passive income stream in sports history. The Jordan Brand generates billions in revenue annually. Michael gets a cut. He doesn’t have to jump anymore. He just has to exist.

Key Asset Breakdown:

- Charlotte Hornets Sale: Bought for $275 million. Sold majority stake at a $3 billion valuation. That is a 10x return. Pure asymmetric upside.

- Nike Royalties: An estimated $250M+ annual payout.

- The Lesson: Do not rent your name. License it. Renting pays once. Licensing pays forever.

2. Ion Tiriac: The Billionaire You Forgot

Estimated Net Worth: $2.1 Billion

You probably haven’t heard of him. That’s by design. Tiriac was a Romanian tennis player and ice hockey pro. Good, not great. Yet, he is richer than Federer. Richer than Nadal.

How? The fall of the Iron Curtain. Tiriac used his sports connections to found the first private bank in post-communist Romania. He didn’t stay in sports. He used sports to enter finance, insurance, and auto leasing.

In our Bachelor in Sports Management, we teach this concept: Sports is a networking platform. Tiriac realized that knowing wealthy people was more valuable than a backhand slice. He traded social capital for financial capital.

3. Magic Johnson: The Infrastructure Builder

Estimated Net Worth: $1.2 Billion

Magic Johnson Enterprises is not a marketing firm. It is an infrastructure firm. Magic looked at urban America and saw what Wall Street missed. High density, high demand, low supply of quality services.

He brought Starbucks to the inner city. He built movie theaters where others wouldn’t. He bought into the Los Angeles Dodgers and the Washington Commanders. Magic is not selling jerseys. He is selling experiences and real estate.

The Strategy:

Find undervalued markets. Partner with institutional capital. Execute where others are afraid to go. Magic proved that “athlete” is just a label you can peel off.

4. Junior Bridgeman: The Franchise Operator

Estimated Net Worth: $600 Million

If you want to understand the true mechanics of wealth, look at Junior Bridgeman. He was a solid NBA player. 12 years. Mostly off the bench. He never made more than $350,000 in a season.

Yet, he is wealthier than 99% of Hall of Famers. Why?

While his teammates were buying cars, Bridgeman was working at Wendy’s. Literally learning the business. He bought franchises. One by one. He built a portfolio of over 450 Wendy’s and Chili’s restaurants. Then he sold them to become a bottler for Coca-Cola.

Bridgeman is the ultimate case study for our students interested in Sports Management Courses in Mumbai. You don’t need to be the MVP. You need to be a capital allocator.

5. Roger Federer: The Equity Play

Estimated Net Worth: $550 Million – $600 Million

Federer left Nike. It seemed insane. They were synonymous. But Nike wanted to keep him as an employee. Uniqlo offered him $300 million over 10 years, with no retirement clause. He could stop playing tomorrow and the check still clears.

But the real move was On Running. Federer didn’t just endorse the Swiss shoe brand. He bought 3% of the company. When On Running went public (IPO), that stake ballooned into hundreds of millions. Endorsements are income. Equity is wealth.

6. Shaquille O’Neal: The Volume Game

Estimated Net Worth: $500 Million

Shaq is everywhere. But look closer. It’s not random. It’s a franchise model. He owns percentages of Five Guys, Papa John’s, gyms, and car washes. He adopts a strategy of high volume, simple businesses.

Shaq understands his personal brand is “fun.” He attaches that “fun” to boring, cash-flowing assets. He is the marketing department; the assets are the fulfillment center. This is a key function we discuss in our article on 5 Key Functions of Sports Management.

7. David Beckham: The Licensing House

Estimated Net Worth: $450 Million

Beckham retired early. But his earnings went up. He treated himself like a corporation. He sold a stake in his brand management company to Authentic Brands Group (ABG) for over $200 million. He effectively sold stock in “David Beckham Inc.”

And then, Inter Miami. When he came to the MLS in 2007, he took a pay cut. Why? For the option to buy an expansion team for $25 million. Today, Inter Miami is valued at over $1 billion. That is a 40x return. He played the long game.

The Gap Between Wages and Wealth

Why do we track this at ISST? Because the industry is changing. The modern sports manager isn’t just negotiating a salary cap. They are structuring equity deals, venture capital funds, and brand partnerships.

Look at the data in our report on Sports Management Salaries in India. The base pay is one thing. But the real money is in understanding the asset class. Whether you want to be an agent, a team owner, or a brand manager, you must understand how to separate time from money.

Key Takeaways for Future Sports Managers

- Equity over Salary: Salary is taxed at the highest rate and stops when you stop. Equity grows tax-deferred until you sell.

- Ownership is Control: Jordan owns the team. Federer owns the shoe company. Bridgeman owns the franchise.

- Networking is Capital: Your network is your net worth. It’s a cliché because it’s true.

The athletes who win the money game are the ones who realize the sport was just the lead generation tool for their business career.

Frequently Asked Questions

Who is the wealthiest retired athlete of all time?

Michael Jordan holds the top spot with an estimated net worth exceeding $3 billion. This is largely due to the sale of the Charlotte Hornets and ongoing royalties from the Jordan Brand.

How did Ion Tiriac get so rich?

Tiriac moved away from sports and founded the Tiriac Group, which has interests in banking, insurance, and real estate in Romania. He capitalized on the economic shift in post-communist Eastern Europe.

Does David Beckham own Inter Miami?

Yes, Beckham is a co-owner of Inter Miami CF. He exercised an option from his 2007 LA Galaxy contract that allowed him to purchase an MLS expansion team for a discounted rate of $25 million.

What is the Junior Bridgeman business model?

Bridgeman’s model focuses on franchising established fast-food brands like Wendy’s and Chili’s. He prioritizes steady cash flow and scalability over high-risk tech investments.

Why is Roger Federer’s net worth so high after retirement?

Federer holds a significant equity stake in On Running, a Swiss shoe company. The company’s IPO drastically increased the value of his holdings beyond his career prize money.

Do retired athletes still make money from endorsements?

Yes, top-tier athletes like Shaq and Beckham structure “lifetime” or long-term deals. They often transition from simple endorsers to brand partners or equity holders.

Is Magic Johnson a billionaire?

Yes, Magic Johnson reached billionaire status through Magic Johnson Enterprises. His wealth comes from stakes in sports teams (Dodgers, Commanders) and life insurance equities.

How can I learn to manage athlete wealth?

You need a foundation in finance and sports administration. Start by exploring a BSc in Sports Management to understand the ecosystem.

Stop Watching, Start Owning

The difference between a fan and a pro is action. The difference between a pro and a mogul is ownership. If you are obsessed with the business behind the game, don’t just read about it.

Get the skills to operate in this world. Whether it’s managing a team, negotiating contracts, or building the next big sports brand, it starts with education. Check out our Bachelor in Sports Management at ISST. The game is waiting. Make your move.